The last decade has seen an increase in availability of investment funds that aim to meet a social, ethical or sustainable objective. In response to the rapid expansion of the sector, the Financial Conduct Authority (FCA), which regulates financial services companies in the UK, has introduced a series of new measures which will change the way funds, and other products and services making sustainability related claims, can be marketed to investors.

The FCA are not acting alone. These measures are part of a new regime being introduced by financial regulators across the globe. The changes are designed to improve the clarity and consistency of information about sustainable investment products. The aim is to ensure that financial products and services that are marketed as sustainable live up to these claims and are backed by robust evidence.

The new FCA rules refer to ‘sustainability’ which is now a defined term with a specific meaning. In simple terms, it refers to a product having ‘environmental or social characteristics’. In recent years, the terminology surrounding ‘sustainability’ has become quite complex with terms such as ‘sustainable’, ‘green’ ‘ethical’ and ‘responsible’ being used interchangeably. This has made it increasingly difficult for investors to understand precisely what these terms mean and to make comparisons between different investment solutions.

In response to the regulatory changes, the FAS Investment Committee resolved to rename the SRI Balanced and SRI Progressive strategies from December 2024. The new model portfolio strategies will be named Balanced Future and Progressive Future. We feel the new naming convention more accurately describes the investment approach adopted within these two CDI model portfolios.

Will the portfolio strategies change?

The FAS Investment Committee will not change the investment approach adopted by the two portfolio strategies. The portfolios will continue to adopt an investment style that aims to invest a large proportion of the portfolio in funds that have a stated ethical investment objective. The portfolio construction process has been strengthened, so that at least 70% of the Balanced Future and Progressive Future portfolios will be invested in funds that have a stated investment policy that either adopts a positive or negative screening process or tracks an appropriate sustainable benchmark.

Apart from a strengthened investment selection process, other aspects of the portfolios will remain unchanged. The maximum asset allocation to equities will remain at 65% for the Balanced Future portfolio and 85% for the Progressive Future portfolio, and the performance measurement benchmarks will also remain unaltered.

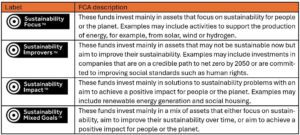

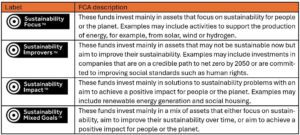

Sustainability labels

To help investors understand and navigate the range of sustainable investment options, the FCA is introducing four new investment labels for funds. These are designed to help investors identify funds with different sustainability goals. These are:-

As these changes start to be introduced, existing funds may decide to start using sustainability labels or make changes to the structure of their funds. New funds – using one of the sustainability labels – may also appear on the market. Not all sustainable funds will choose to use the new sustainable labels. The FAS Investment Committee will continue to select investment funds for inclusion within the Balanced Future and Progressive Future portfolios based on the sustainable criteria and investment approach adopted, whether the investment manager chooses to use a sustainability label or not. The FAS Investment Committee have not sought to obtain a label for the Balanced Future and Progressive Future portfolios.

Meeting your preferences

Our robust advice process will not change following the introduction of the new regime. Where we provide you with advice, we will discuss with you any preference you may have for sustainable investing and will take your preferences into account when making our recommendations. The FAS Investment Committee will continue to monitor sustainable investment solutions available to our clients as they come onto the market. The new labels and disclosure information will help us to identify potentially suitable investment solutions to reflect different client preferences.

Summary

Whilst the naming convention of the SRI Balanced and SRI Progressive portfolios has changed, the objective, investment risk or investment approach will remain unaltered.

We understand that you may have questions in relation to these changes. Please do not hesitate to contact your adviser to speak further on the changes being introduced, or any other matter relating to your portfolio.