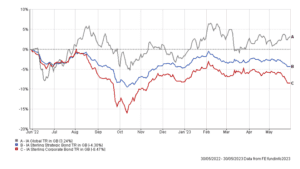

History will show that 2022 was a highly unusual year for Bond investors, with the performance of Corporate and Government Bonds struggling under the weight of higher inflation and rapidly tightening monetary policy. Whilst Equities markets have produced a solid performance, Bonds have acted as a detractor to overall performance in a diversified, balanced portfolio. The chart below demonstrates the divergence in performance and shows the relative total return of the IA Global sector (Global Equities – grey line) compared to the IA Sterling Strategic Bond sector (blue line) and IA Sterling Corporate Bond sector (red line) over the last year.

Sterling Bonds first saw weakness around the start of the Russian invasion of Ukraine, when it became apparent that energy and food prices would increase sharply. To combat the rapidly increasing inflation, central banks began hiking rates aggressively. This trend continued through the year and the negative sentiment accelerated during September and October, around the same time as the ill-fated mini-Budget was announced by the Liz Truss administration.

As inflationary pressures began to ease through November and December, Bond markets began to show signs of returning to normality. The first quarter of this year saw this improved performance continue, as expectation increased that the series of interest rate increases imposed by central banks in the US, UK and Eurozone would shortly be ending.

Core inflation remains stubborn

More recently, we have seen Bond prices give back some of the ground regained over the last six months. This is largely due to the most recent inflation data in the UK and US showing that core inflation (which is a measure of inflation that does not include food and energy costs, which are more volatile) is proving stubborn, and whilst falling gradually in the US, Core Consumer Price Inflation rose to 6.8% in the UK for April (source: ONS June 2023).

As a result of this data, where markets were expecting the Federal Reserve and Bank of England to have paused the hiking cycle by now, markets have now priced in a 66% chance of a further 0.25% increase in US base rates in June, and markets also now expect the Bank of England to raise rates by a similar amount next month.

Whilst inflation is perhaps not falling as quickly as expected, we still maintain that inflation will return to more comfortable levels by the end of the year. This is likely to remove much of the pressure on Bonds, which are currently facing stiff competition from overnight interest rates.

Where next for Bonds?

As we move towards the end of 2023, inflation is likely to be under control and the focus may well shift to the pace and timing of interest rate cuts as we head into next year. Indeed, if economic growth slows sufficiently, it is entirely possible that central banks have hit the brake pedal too hard, and inflation could undershoot the target range next year. This could mean that interest rates could be cut significantly during 2024 and 2025.

It is important to remember that a Bond usually pays a fixed rate of interest and as these become more attractive compared to interest rates generally, there is potential for Bond values to rebound sharply. We are in regular contact with leading Bond fund managers, who are seeing very good opportunities in fixed interest at the current time, and the actively managed funds that we favour are generally increasing duration (i.e. taking on a little more risk) in anticipation of improved conditions for Bonds later this year and into 2024.

A brighter outlook

The last twelve months have undoubtedly seen difficult conditions for Bond investors and allocations to Fixed interest has dragged back the performance of balanced, diversified portfolios. It has been a frustrating period for investors and volatile Bond markets have proven very difficult to navigate with any degree of success.

We believe we are close to a turning point within Bond markets, as the pendulum of monetary policy begins to swing back in favour of fixed interest securities. The most recent inflation data has led central banks to adjust their expectations a little, but we believe it hasn’t changed the long-term picture. Given the expectations for both inflation and interest rates to fall back over the coming year, the outlook for Bond markets is much brighter than at any point since 2021, and we share the optimism of leading Bond fund managers, who are seeing good opportunities for performance in credit markets.

Please contact us if you would like to discuss the impact of the performance of Bonds and Fixed Interest on your portfolio.